- 1. swapsswaps

-- swap means exchange-- swap means exchange

-- exchange of future cash flows between two-- exchange of future cash flows between two

parties on a predetermined basisparties on a predetermined basis

-- a nseries of forward contracts-- a nseries of forward contracts

-- types-- types

I Interest rate swapI Interest rate swap

-- coupon swap-- coupon swap

-- basis swap-- basis swap

-- cross – currency swap-- cross – currency swap

- 2. COUPON SWAP A FLOWCOUPON SWAP A FLOW

CHARTCHART

Abc requires 7 year fixed rate funding

Abc raises a 7 year floating rate debt at

0.50% over libor (i.e. in the market where

it has a comparative advantage)

Abc locatesxyz , a company which needs 7

year floating rate funds

- 3. Interest rate swapsInterest rate swaps

Coupon swapCoupon swap

OrOr

Plain vanilla coupon swapPlain vanilla coupon swap

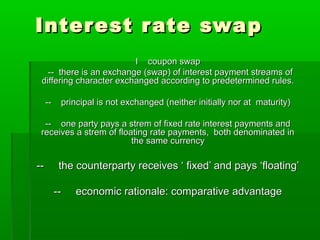

- 4. Interest rate swapInterest rate swap

I coupon swapI coupon swap

-- there is an exchange (swap) of interest payment streams of-- there is an exchange (swap) of interest payment streams of

differing character exchanged according to predetermined rules.differing character exchanged according to predetermined rules.

-- principal is not exchanged (neither initially nor at maturity)-- principal is not exchanged (neither initially nor at maturity)

-- one party pays a strem of fixed rate interest payments and-- one party pays a strem of fixed rate interest payments and

receives a strem of floating rate payments, both denominated inreceives a strem of floating rate payments, both denominated in

the same currencythe same currency

-- the counterparty receives ‘ fixed’ and pays ‘floating’-- the counterparty receives ‘ fixed’ and pays ‘floating’

-- economic rationale: comparative advantage-- economic rationale: comparative advantage

- 5. Some companies have a comparative advantage in the fixed rateSome companies have a comparative advantage in the fixed rate

market, while other companies have a comparative advantage inmarket, while other companies have a comparative advantage in

floating rate market. Hence companies having comparativefloating rate market. Hence companies having comparative

advantage in the fixed rate market might borrow fixed even thoughadvantage in the fixed rate market might borrow fixed even though

even though it is desirous of a floating rate loan.Using a couponeven though it is desirous of a floating rate loan.Using a coupon

swap, the company can convert fixed interest payments to floatingswap, the company can convert fixed interest payments to floating

interest payments.interest payments.

Benchmark interest ratesBenchmark interest rates

Fixed -- yield on government bondsFixed -- yield on government bonds

FLOTING -- LIBORFLOTING -- LIBOR

Coupon swap results in reduction in borowing costs for both partiesCoupon swap results in reduction in borowing costs for both parties

- 6. Mechanism of aMechanism of a

coupon swapcoupon swap

COMPANYCOMPANY ABC LTD.ABC LTD. XYZ LTD.XYZ LTD.

FLOTINGFLOTING

RATERATE

LIBOR + 0.5%LIBOR + 0.5% LIBOR +LIBOR +

0.125%0.125%

FIXEDRATEFIXEDRATE 9.5% P.A9.5% P.A 8% P.A8% P.A

RATINGRATING ‘‘AA’AA’ ‘‘AAA’AAA’

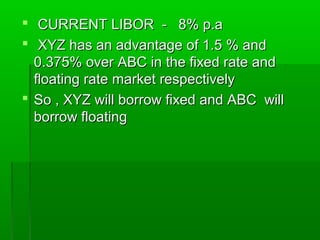

- 7. CURRENT LIBOR - 8% p.aCURRENT LIBOR - 8% p.a

XYZ has an advantage of 1.5 % andXYZ has an advantage of 1.5 % and

0.375% over ABC in the fixed rate and0.375% over ABC in the fixed rate and

floating rate market respectivelyfloating rate market respectively

So , XYZ will borrow fixed and ABC willSo , XYZ will borrow fixed and ABC will

borrow floatingborrow floating

- 8. Abc raises floating money pays 0.5% overAbc raises floating money pays 0.5% over

libor to lenders receives libor from xyzlibor to lenders receives libor from xyz

pays 8.5% fixed to xyzpays 8.5% fixed to xyz

Xyz raises fixed rate pays 8% to lendersXyz raises fixed rate pays 8% to lenders

pays libor to abc. Receives fixed 8.5%pays libor to abc. Receives fixed 8.5%

from abcfrom abc

- 9. COSTCOST ABCABC XYZXYZ

PRE- SWAP(A)PRE- SWAP(A) 9.5%9.5% LIBOR +LIBOR +

0.125%0.125%

i.e.8.125i.e.8.125

POST-POST-

SWAP(B)SWAP(B)

9%9% LIBOR - 0.5%LIBOR - 0.5%

i.e 7.50%i.e 7.50%

SAVINGS(A-B)SAVINGS(A-B) 0.5%0.5% 0.625%0.625%

- 10. TOTAL GAIN TO ALL PARTIES FROM THETOTAL GAIN TO ALL PARTIES FROM THE

SWAPSWAP

EQALS THE DIFFERENCE BETWEEN THEEQALS THE DIFFERENCE BETWEEN THE

INTEREST RATES AVAILABLE FOR THEINTEREST RATES AVAILABLE FOR THE

TWO COMPANIES IN THE FIXED MARKETSTWO COMPANIES IN THE FIXED MARKETS

MINUS THE DIFFERENCE BETWEEN THEMINUS THE DIFFERENCE BETWEEN THE

INTEREST RATES AVAILABLE TO THE TWOINTEREST RATES AVAILABLE TO THE TWO

COMPANIES IN THE FLOATING RATE MKTSCOMPANIES IN THE FLOATING RATE MKTS

I.E (9.50% - 8.0%) – (8.50% -8.125%)I.E (9.50% - 8.0%) – (8.50% -8.125%)

=1.1250%=0.5% TO ABC =0.625% TO XYZ=1.1250%=0.5% TO ABC =0.625% TO XYZ

- 11. Coupon swap – a flowCoupon swap – a flow

chartchart

Abc requires 7 year fixed rate fundingAbc requires 7 year fixed rate funding

Abc raises a 7 ear floating rate debt at 0.5%Abc raises a 7 ear floating rate debt at 0.5%

over LIBOR9(i.e in the market where it has aover LIBOR9(i.e in the market where it has a

comparative advantage,or a lowercomparative advantage,or a lower

disadvantagedisadvantage

Abc locates Xyz, a company which needs 7Abc locates Xyz, a company which needs 7

year floating rate funds(same amount andyear floating rate funds(same amount and

parallel repayment), and has a comparativeparallel repayment), and has a comparative

advantage over Abc in the fixed rate market.advantage over Abc in the fixed rate market.

- 12. Xyz raises a 7year fixed rate debt at 8%p.aXyz raises a 7year fixed rate debt at 8%p.a

Xyz and Abc swap interest liabilities.XyzXyz and Abc swap interest liabilities.Xyz

agrees to pay interest at say Libor to Abc , andagrees to pay interest at say Libor to Abc , and

Abc agrees to pay interest at say 8.5% to Xyz.Abc agrees to pay interest at say 8.5% to Xyz.

Xyz has now got floating rate funds at anXyz has now got floating rate funds at an

effective cost of Libor to Abc but makes a profiteffective cost of Libor to Abc but makes a profit

of 0.5% on the fixed side , or 0.625% belowof 0.5% on the fixed side , or 0.625% below

what it would have otherwise paid for floatingwhat it would have otherwise paid for floating

rate funds.rate funds.

- 13. Abc has now got fixed rate funds at anAbc has now got fixed rate funds at an

effective cost of 9%p.a (it pays 8.55 toeffective cost of 9%p.a (it pays 8.55 to

Xyz and makes a loss of 0.5% on theXyz and makes a loss of 0.5% on the

floating side or below what it would havefloating side or below what it would have

otherwise paid for fixed rate fundsotherwise paid for fixed rate funds

- 14. Swap constraintsSwap constraints

I Counterparties should have differing andI Counterparties should have differing and

mutually complementary needs.mutually complementary needs.

II The principal amount borrowed by theII The principal amount borrowed by the

counterparties should be of identical amountcounterparties should be of identical amount

and maturity.and maturity.

III Counterparty riskIII Counterparty risk

-- in practice, major international banks step-- in practice, major international banks step

in and run their own swap bookin and run their own swap book

-- a bank would enter into a separate swap-- a bank would enter into a separate swap

transaction with each partytransaction with each party

- 15. -- a bank would do a swap without the-- a bank would do a swap without the

ready availability of a matchingready availability of a matching

counterparty and hedge its exposures incounterparty and hedge its exposures in

the market, until another counterpartythe market, until another counterparty

with opposite requirement is located.with opposite requirement is located.

-- Thus with an intermediary, the-- Thus with an intermediary, the

comparative advantage gets slit threecomparative advantage gets slit three

ways 9between the bank and the twoways 9between the bank and the two

counterpartiescounterparties

- 16. Curency swapsCurency swaps

1. Exchange of cash flows1. Exchange of cash flows

2. On NPV basis, identical to covering on2. On NPV basis, identical to covering on

forward basis.forward basis.

3. Optimise liability profile3. Optimise liability profile

4. Use as hedge against economic exposures4. Use as hedge against economic exposures

5. Timing – when temptation to do something5. Timing – when temptation to do something

is leastis least

6. Accounting/tax implications6. Accounting/tax implications

- 17. Mechanics of aMechanics of a

currency swapcurrency swap

companycompany usdusd pdspds

AA 6.5%6.5% 8.5%8.5%

BB 8.5%8.5% 9.5%9.5%

-- ‘ A’ has an advantage of 2% and 1%

over

‘B’ in borrowing dollars and sterling

respectively.

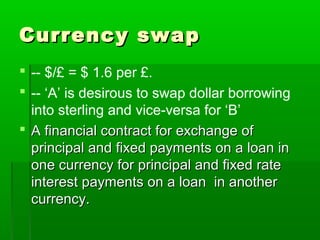

- 18. Currency swapCurrency swap

-- $/£ = $ 1.6 per £.

-- ‘A’ is desirous to swap dollar borrowing

into sterling and vice-versa for ‘B’

A financial contract for exchange ofA financial contract for exchange of

principal and fixed payments on a loan inprincipal and fixed payments on a loan in

one currency for principal and fixed rateone currency for principal and fixed rate

interest payments on a loan in anotherinterest payments on a loan in another

currency.currency.

- 19. The exchange rate at which the principal andThe exchange rate at which the principal and

interest payments are to be exchanged in theinterest payments are to be exchanged in the

two currencies during the life of the swap is thetwo currencies during the life of the swap is the

one ruling in the spot market on the day theone ruling in the spot market on the day the

currency swap is entered into.currency swap is entered into.

Like interest rate swaps , currency swaps areLike interest rate swaps , currency swaps are

also motivated by comparative advantages.also motivated by comparative advantages.

Currency swaps facilitate a corporate to alterCurrency swaps facilitate a corporate to alter

its existing currency flows and risk:rewardits existing currency flows and risk:reward

strategy.strategy.

- 20. Exchange of principal takes place at theExchange of principal takes place at the

beginning and at the end whereasbeginning and at the end whereas

interest payments occur during the life ofinterest payments occur during the life of

the swap.the swap.

usually banks act as intermediariesusually banks act as intermediaries

thereby eliminating couterparty risk.thereby eliminating couterparty risk.

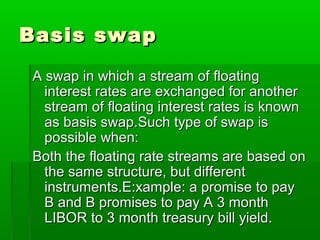

- 21. Basis swapBasis swap

A swap in which a stream of floatingA swap in which a stream of floating

interest rates are exchanged for anotherinterest rates are exchanged for another

stream of floating interest rates is knownstream of floating interest rates is known

as basis swap.Such type of swap isas basis swap.Such type of swap is

possible when:possible when:

Both the floating rate streams are based onBoth the floating rate streams are based on

the same structure, but differentthe same structure, but different

instruments.E:xample: a promise to payinstruments.E:xample: a promise to pay

B and B promises to pay A 3 monthB and B promises to pay A 3 month

LIBOR to 3 month treasury bill yield.LIBOR to 3 month treasury bill yield.

- 22. Interest base :money market9actual /360Interest base :money market9actual /360

or 365) or Bond (30 days month and 360or 365) or Bond (30 days month and 360

days year)days year)

Periodicity annually, semiPeriodicity annually, semi

annually,quarterlyannually,quarterly